The Omnicom-IPG Merger

What Marketing and Procurement Leaders Need to Know

A New Era for Advertising?

In a move that's set to reshape the advertising landscape, Omnicom and IPG are proposing a merger that will create one of the largest marketing and communications conglomerates in the world. This isn't just about bigger numbers; it's about a fundamental shift in how agencies operate and how brands like yours access marketing expertise.

Why is this happening now? Several factors are at play: intensifying competition from consulting firms, the rise of in-housing, the need for greater scale to compete in the digital age, and the constant pressure to innovate. This merger aims to address these challenges, but it also raises critical questions for marketing and procurement leaders like you.

How could this impact your organization? The potential implications are far-reaching, from pricing and negotiation dynamics to service delivery and access to talent. You'll need to proactively assess your agency relationships, understand the evolving capabilities of the merged entity, and strategically navigate the changes to ensure you continue to get the best value and results for your brand.

👉 Bookmark this page!

This is your definitive guide to understanding the Omnicom-IPG merger. We'll break down the key drivers, analyze the potential impacts, and provide actionable strategies to help you make informed decisions and achieve your marketing objectives.

Think of this page as your strategic command center. We're cutting through the noise and providing you with the insights you need to understand this complex merger. We'll cover everything from the deal's structure to specific negotiation strategies. Our goal is to empower you to confidently navigate the changes and optimize your marketing investments.

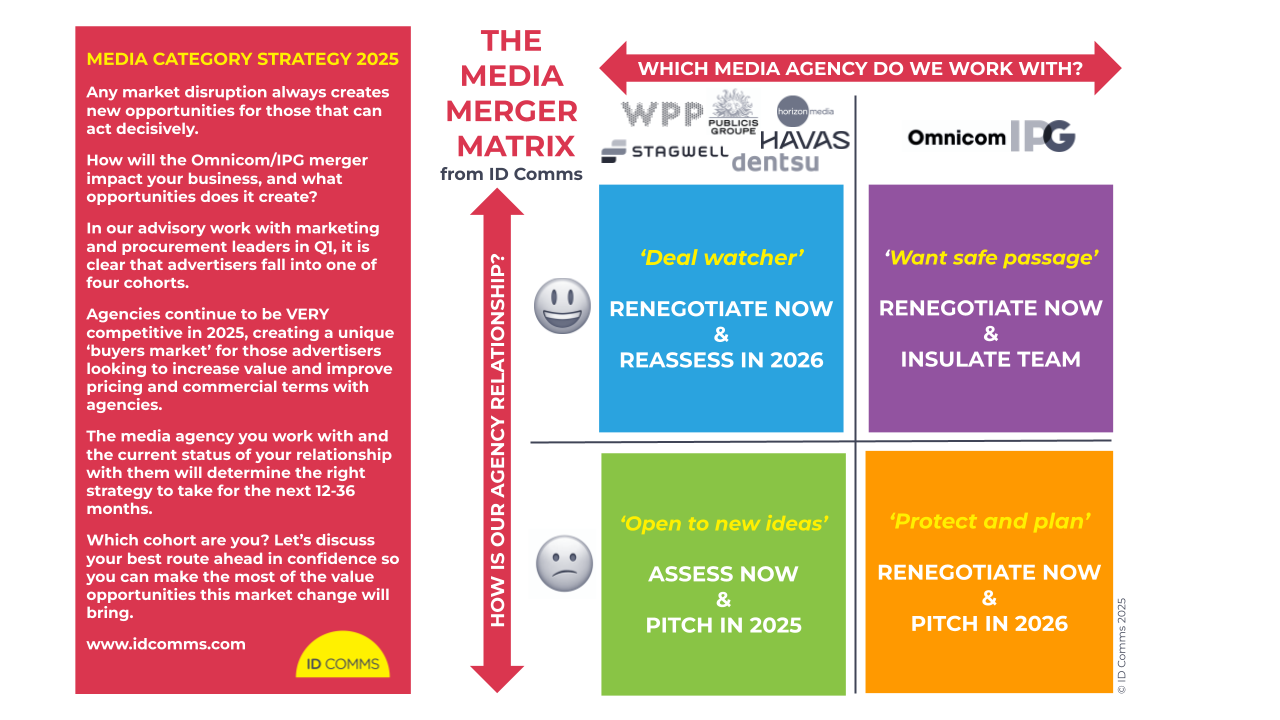

THE MEDIA MERGER MATRIX

At ID Comms, we’ve been advising marketing and procurement leaders through this change and have seen clear patterns emerge. To help brands navigate this moment with clarity, we’ve created the Media Merger Matrix—a framework for making smart, timely decisions about agency relationships during this time of flux.

Advertisers fall into one of four strategic cohorts, based on their agency affiliation (Omnicom/IPG or not) and how satisfied they are with the current partnership.

The bottom line: Whether you’re with a merging agency or not, every advertiser stands to gain (or lose) depending on where they fall in this matrix. Let’s see what your next winning move should be.

To read more and to download your copy of the matrix, see The Media Merger Matrix: How Advertisers Can Turn Omnicom’s Disruption Into Opportunity.

Table of Contents

Implications for Advertisers: What You Need to Know

Pricing and Negotiation

The increased scale of the merged entity could lead to changes in pricing and negotiation dynamics. Advertisers should carefully evaluate their agency contracts and prepare for potential shifts in bargaining power.

Service Offerings

The combined entity will likely offer a broader range of services, potentially providing integrated solutions across various disciplines. However, advertisers should assess whether this breadth comes at the expense of specialized expertise.

Innovation and Technology

The merger could lead to increased investment in technology and data analytics, which could benefit advertisers. However, it's also important to consider potential integration challenges and the impact on existing technology partnerships.

Client Relationships

Mergers often lead to changes in account assignments and client relationships. Advertisers should proactively engage with their agencies to understand how the merger might affect their accounts.

Media Buying

The combined media buying power of the merged entity could give them significant leverage in negotiations with media owners. This could lead to both opportunities and challenges for advertisers.

Opportunities for Advertisers: What You Need to Do

At this point in the game, there are more questions than answers. But, there are still things advertisers can do as we all wait to see how this shakes out.

Don’t Panic—But Start Preparing: The merger isn’t a done deal yet, so don’t make any rash moves. But it’s smart to start assessing your agency relationships and thinking about potential next steps.

Ask the Hard Questions: If you’re in the middle of a pitch with one of these agencies, put this merger on the table:

- How will this affect your ability to deliver?

- What specific benefits will this new holding company bring to me?

Reassess Your Current Agency Setup: If you’re working with Omnicom or IPG agencies, take a closer look at your agreements and team structures:

- Are your contracts still protecting your interests?

- Will your agency have the resources to meet your needs post-merger?

Think About the Long Game: Don’t just look at what this merger means now—think about what it means for the future of your media strategy. Are your partnerships helping you grow, or just keeping the lights on?

Stay Opportunistic: A merger this big shakes up the market, and that means opportunity for those looking for competitive advantage. The influx of talent could be a chance to strengthen your team or explore new agency options.

For more on what advertisers are worried about and helpful next steps, read What the Omnicom-IPG Merger Means for Advertisers.

Understanding the Merger Details: Context, Drivers, Facts and Figures

The Deal Itself

The specifics of the merger, while not fully finalized at the time of writing will likely involve a complex stock swap and organizational restructuring. What's crucial to understand is that the aim is to combine the strengths of Omnicom and IPG under a unified umbrella. Key things to watch out for as the deal progresses are the regulatory hurdles it needs to clear across different countries, and any potential divestitures or concessions required by regulators. We'll keep you updated on these developments as they unfold.

Market Forces at Play

The ad industry isn't static. It's undergoing a major transformation, and this merger is a direct response to several powerful forces:

- The Consultancy Challenge: Accenture Interactive, Deloitte Digital, and others have aggressively moved into the marketing space, offering end-to-end solutions that compete directly with traditional agencies. This merger is partly about building scale to better compete with these giants.

- The In-Housing Trend: More and more brands are bringing marketing functions in-house, seeking greater control and efficiency. Agencies need to demonstrate their unique value proposition to retain clients.

- The Need for Scale: In the digital age, data and technology are paramount. Building and maintaining cutting-edge capabilities requires significant investment. A merged Omnicom-IPG will have greater resources to invest in these areas.

- Technological Disruption: AI, automation, and programmatic advertising are changing the game. Agencies need to adapt and offer innovative solutions to stay ahead.

- Evolving Client Needs: Clients are demanding more integrated, data-driven, and agile marketing solutions. They want seamless collaboration across different disciplines.

This merger isn't just about consolidation; it's about survival and thriving in a rapidly changing environment.

Potential Impacts on Brands and Marketing Organizations

Impact on Pricing & Negotiation:

Let's be frank: pricing is a major concern. A larger entity could mean less competition, potentially leading to increased prices. However, it's not a foregone conclusion. Here's what to consider:

- Reduced Competition? In certain specialized areas, the merger could significantly reduce the number of viable agency options. This gives the merged entity more leverage.

- Bundled Services: Expect to see more bundled service offerings. Carefully evaluate the value of these packages – are you truly getting what you need, or are you paying for unnecessary extras?

- Negotiation Strategies: Now is the time to sharpen your negotiation skills. Consider engaging procurement specialists to help you secure the best possible terms. Explore performance-based pricing models to align incentives.

Impact on Service & Capabilities:

The merger could lead to both improvements and potential drawbacks in service:

- Broader Capabilities: The merged entity should offer a wider range of services, from creative and media to data analytics and technology consulting. This could be a one-stop shop for your marketing needs.

- Service Quality: Will service quality improve or decline? That's the million-dollar question. Internal restructuring and potential talent attrition could disrupt service delivery.

- Gaps in Service: Be aware of potential gaps. The merged entity might prioritize certain areas over others, leaving some clients underserved.

Pro Tip: Communicate openly with your agency contacts. Ask them about their plans for the future and how the merger will impact your account.

Impact on Innovation & Technology:

Innovation is the lifeblood of marketing. Here's how the merger could affect it:

- Accelerated Innovation: With greater resources, the merged entity could invest more heavily in research and development, leading to faster innovation.

- Data & Technology Leverage: A key goal of the merger is to leverage data and technology more effectively. Expect to see more data-driven insights and personalized marketing solutions.

- New Solutions: Keep an eye out for new and innovative solutions that emerge from the merged entity. Be prepared to adapt and experiment with new approaches.

However, be cautious of "innovation theater." Make sure that any new technologies or approaches are actually delivering tangible results.

Impact on Talent & Resources:

Talent is the engine of any agency. Here's what to watch for:

- Talent Attrition: Mergers often lead to layoffs and talent attrition. Losing key members of your account team can disrupt service and impact performance.

- Attracting & Retaining Talent: The merged entity will need to attract and retain top talent to succeed. This will require competitive compensation, challenging opportunities, and a positive work environment.

- Resource Allocation: Resources could be reallocated to higher-priority clients or strategic initiatives. This could leave smaller clients feeling neglected.

Pro Tip: Build strong relationships with your agency team. This will help you retain key talent and ensure continuity of service.

Geographic Considerations:

The impact of the merger will vary depending on your geographic market. In some regions, the merged entity may have a dominant market share, while in others, the competition will remain fierce. Consider how the merger will affect your local agency landscape.

.jpeg)

Strategic Guidance for Marketing and Procurement Leaders

Assessing Your Agency Relationships:

Now is the time to take a hard look at your agency relationships. Don't wait for the dust to settle – be proactive.

- Performance Review: Conduct a thorough review of your agency's performance over the past year. Are they meeting your expectations? Are they delivering results?

- Risk & Opportunity: Identify potential risks and opportunities associated with the merger. What could go wrong? What new possibilities might emerge?

- Diversify Your Roster: Consider diversifying your agency roster to reduce your reliance on a single entity. This will give you more leverage and flexibility.

Negotiation Strategies:

Don't be a passive observer. Take control of your negotiations.

- Competitive Bidding: Leverage competitive bidding to drive down prices and improve service. Don't be afraid to shop around.

- Performance-Based Incentives: Negotiate performance-based incentives to align your agency's goals with your own.

- Alternative Fee Structures: Explore alternative fee structures, such as value-based pricing or hybrid models. Don't be afraid to challenge the traditional hourly rate model.

Risk Mitigation Strategies:

Prepare for the worst, hope for the best.

- Contingency Plans: Develop contingency plans in case your agency relationship is disrupted. Identify alternative agencies that could step in if needed.

- Strengthen Internal Capabilities: Invest in your internal marketing capabilities to reduce your reliance on external agencies.

- Explore Alternatives: Don't put all your eggs in one basket. Explore alternative agency options, including independent agencies and specialist firms.

Maximizing Value:

Turn the merger into an opportunity.

- Seek Innovation: Look for new opportunities to innovate and collaborate with the merged entity.

- Negotiate Access: Negotiate access to the merged entity's expanded capabilities, such as data analytics and technology consulting.

- Drive Efficiency: Work with the merged entity to drive greater efficiency and cost savings.

Key Questions to Ask:

Communication is key. Here are some essential questions to ask your agencies and the merged entity:

- Account Team: "How will the merger affect my account team? Will there be any changes in personnel?"

- Service Delivery: "What changes can I expect in service delivery? Will there be any disruptions?"

- Pricing & Fees: "How will pricing and fees be impacted? Will there be any changes to our contract?"

- New Capabilities: "What new capabilities will be available to me as a result of the merger?"

- Innovation Roadmap: "What is your innovation roadmap? How will you be investing in new technologies and solutions?"

- Data Privacy & Security: "How will you ensure the privacy and security of my data?"

- Conflict of Interest: "How will you manage potential conflicts of interest with other clients?"

Don't be afraid to ask tough questions. Your goal is to understand the potential impact of the merger and protect your interests."

A Guide to Running an Agency Pitch, if Needed:

If you're considering a change of agency, a formal agency review is essential. Here's a streamlined approach:

- Define Your Needs: Clarify your goals, budget, and desired outcomes.

- Identify Candidates: Research potential agencies, focusing on those with relevant expertise and experience. Consider both large and independent firms.

- Send RFIs (Request for Information): Gather detailed information about each agency's capabilities, team, and approach.

- Shortlist Candidates: Select a few finalists to participate in a formal pitch.

- Conduct Pitches: Provide a clear brief and allow each agency to present their ideas and strategies.

- Evaluate and Select: Assess each agency based on creativity, strategic thinking, cultural fit, and value for money.

Remember to involve key stakeholders throughout the process to ensure buy-in.

Alternatives to the Merged Entity: Highlighting Independent and Specialist Agencies

The merged Omnicom-IPG won't be the only game in town. Independent and specialist agencies offer compelling alternatives.

- Independent Agencies: These agencies often provide more personalized service, greater flexibility, and a more entrepreneurial spirit. They can be a great fit for brands seeking a more agile and responsive partner.

- Specialist Firms: These firms focus on specific areas of marketing, such as social media, content marketing, or data analytics. They offer deep expertise and a focused approach.

Don't overlook these options. They could provide a better fit for your needs and budget.

The Future Agency Landscape

Predictions & Scenarios:

It's impossible to predict the future with certainty, but here are some potential scenarios to consider:

- Further Consolidation: This merger could trigger further consolidation in the advertising industry, as other agencies seek to gain scale and compete.

- Rise of Hybrid Models: We may see more hybrid agency models that combine in-house capabilities with external expertise.

- Data Dominance: Data will become even more critical, with agencies that can effectively leverage data to drive results gaining a competitive advantage.

- AI-Powered Marketing: Artificial intelligence will play an increasingly important role in marketing, automating tasks and personalizing customer experiences.

Stay informed and be prepared to adapt to the evolving landscape.

The Evolving Agency Model:

The traditional agency model is being disrupted. Agencies need to evolve to meet the changing needs of clients.

- From Silos to Integration: Agencies need to break down silos and offer more integrated solutions.

- From Creativity to Data: Creativity is still important, but it needs to be informed by data.

- From Project-Based to Partnership: Agencies need to move beyond project-based work and build long-term partnerships with clients.

- From Cost Center to Value Creator: Agencies need to demonstrate their value by delivering tangible results and driving business growth.

Implications for Other Agency Groups and Future M&A:

This move by Omnicom and IPG is likely to send ripples across the entire agency landscape, making other players re-evaluate their strategies. Here's what we might see:

- Other Major Agency Groups: Expect WPP, Publicis, Dentsu, and Accenture Song to carefully analyze their own positions. They may pursue acquisitions to bolster capabilities in specific areas, forge strategic alliances, or double down on their existing strengths to differentiate themselves.

- Smaller and Independent Agencies: This merger could create opportunities for smaller and independent agencies. Brands seeking more personalized service, specialized expertise, or a less bureaucratic approach may turn to these alternatives. These agencies could also become attractive acquisition targets for larger groups looking to expand their offerings.

- Future M&A Activity: This deal could spur further consolidation in the industry. We might see:

- Strategic Acquisitions: Larger agencies acquiring smaller, specialized firms to enhance their capabilities in areas like data analytics, e-commerce, or content creation.

- Regional Consolidations: Agencies merging within specific geographic markets to gain a stronger foothold and better serve local clients.

- Private Equity Involvement: Private equity firms could become more active in the agency space, seeking to consolidate smaller players and create larger, more efficient entities.

Omnicom-IPG Execs on #MediaSnack

Glossary of Terms

Ad Exchange: A digital marketplace that enables advertisers and publishers to buy and sell ad inventory in real-time, often through programmatic bidding.

Ad Fraud: Deceptive practices intended to generate fraudulent revenue from online advertising, such as bot traffic or ad stacking.

Ad Server: A technology platform that stores and delivers online advertisements, tracks ad performance, and manages ad campaigns.

Agency of Record (AOR): The primary advertising agency responsible for handling a significant portion (or all) of a client's marketing and advertising needs.

Audience Targeting: The process of identifying and reaching specific groups of people based on their demographics, interests, behaviors, or other characteristics.

Attribution Modeling: A set of rules that determine how credit for sales and conversions is assigned to different touchpoints in the customer journey.

Behavioral Targeting: Targeting users based on their past online activities, such as websites visited, searches performed, or products purchased.

Bundled Services: A package of multiple services offered together at a single price. In the context of agencies, this might include creative, media, digital, and data analytics.

Competitive Bidding (Agency Review/Beauty Parade): A process where multiple agencies are invited to pitch their services to a client in a competitive environment, typically as part of the agency selection process.

Consultancy (in the context of marketing): Firms like Accenture, Deloitte, and McKinsey that offer marketing and advertising services alongside their traditional consulting offerings. They often emphasize data, technology, and business strategy.

Contextual Targeting: Placing ads on websites or content that are relevant to the ad's message.

Cost Per Click (CPC): An advertising pricing model where advertisers pay only when a user clicks on their ad.

Cost Per Mille (CPM) or Cost Per Thousand: An advertising pricing model where advertisers pay a fixed amount for every 1,000 impressions (views) of their ad. "Mille" is Latin for thousand.

Data Management Platform (DMP): A centralized platform for collecting, organizing, and activating first-party, second-party, and third-party data for targeted advertising and personalization.

Demand-Side Platform (DSP): A technology platform used by advertisers to buy ad inventory programmatically across multiple ad exchanges and networks.

Direct Deal (Programmatic Direct): A negotiated agreement between a publisher and an advertiser to buy and sell ad inventory programmatically, often with guaranteed pricing and placements.

First-Party Data: Data collected directly from your customers (e.g., website visits, purchase history, email interactions).

Frequency Capping: Limiting the number of times a specific user is shown the same ad within a given period.

Impression: A single instance of an advertisement being displayed on a web page or app.

In-Housing: The practice of bringing marketing functions (e.g., creative, media buying, social media) internally rather than outsourcing them to agencies.

Integrated Marketing: A holistic approach to marketing that combines different channels and tactics to deliver a unified and consistent brand message across all touchpoints.

Key Performance Indicator (KPI): A measurable value that demonstrates how effectively a company is achieving key business objectives.

Lookalike Modeling: Identifying and targeting new users who share similar characteristics and behaviors to your existing customers.

Media Buying: The process of purchasing advertising space and time on various media channels (e.g., TV, radio, digital) to reach a target audience.

Native Advertising: Ads that are designed to blend seamlessly with the surrounding content of a website or app.

Performance-Based Pricing: A pricing model where the agency's fees are tied to the achievement of specific performance goals (e.g., increased sales, higher website traffic, improved brand awareness).

Programmatic Advertising: The automated buying and selling of advertising space in real-time, using data and algorithms to target specific audiences.

Real-Time Bidding (RTB): A programmatic auction where advertisers bid on individual ad impressions in real-time, allowing them to target specific users with personalized ads.

Request for Information (RFI): A document used to gather information from potential vendors or agencies about their capabilities, experience, and pricing.

Retargeting (Remarketing): Targeting users who have previously interacted with your website or app with relevant ads, encouraging them to return and complete a purchase or other desired action.

Return on Investment (ROI): A metric used to measure the profitability of an investment. In marketing, ROI is calculated by dividing the net profit generated by a marketing campaign by the cost of the campaign.

Second-Party Data: Data shared directly between two organizations, often through a partnership or agreement.

Supply-Side Platform (SSP): A technology platform used by publishers to manage their ad inventory and sell it to advertisers through programmatic channels.

Third-Party Data: Data collected from various sources that are not directly related to your business (e.g., demographic data, online browsing behavior).

Transparency (in digital advertising): Visibility into the various costs and fees associated with digital ad campaigns, as well as the sources of traffic and the performance of different ad placements.

Value-Based Pricing: A pricing model where the agency's fees are based on the perceived value they deliver to the client, rather than on the cost of their services.

Viewability: A metric that measures whether an ad was actually seen by a user, based on factors such as the ad's position on the page and the amount of time it was visible.

Whitelist/Blacklist (for ad placements): Lists of websites or apps that are either approved (whitelist) or blocked (blacklist) for ad placements, allowing advertisers to control where their ads appear.

White-Labeling: A product or service produced by one company (the provider) that other companies (the marketers) rebrand and sell as their own.

-1.png?width=798&height=450&name=%23MS%20Thumbnail%20FEB2025%20(1)-1.png)